As an accountant prepares the CFS using the indirect method, they can identify increases and decreases in the balance sheet that are the result of non-cash transactions. The CFS is distinct from the income statement and the balance sheet because it does not include the amount of future incoming and outgoing cash that has been recorded as revenues and expenses. Therefore, cash is not the same as net income, which includes cash sales as well as sales made on credit on the income statements. It looks at cash flows from investing (CFI) and is the result of investment gains and losses.

Create a free account to unlock this Template

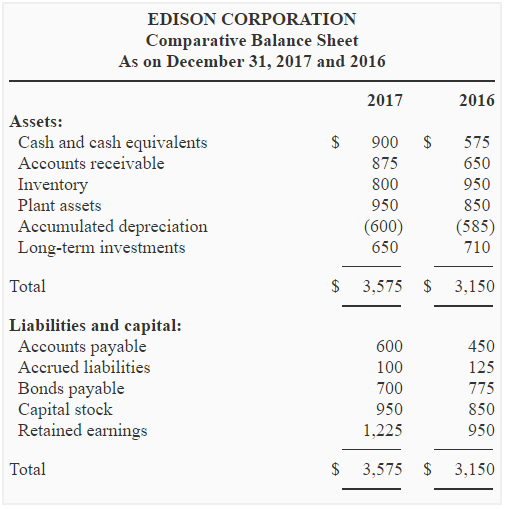

As for the balance sheet, the net cash flow reported on the CFS should equal the net change in the various line items reported on the balance sheet. This excludes cash and cash equivalents and non-cash accounts, such as accumulated depreciation and accumulated amortization. For example, if you calculate cash flow for 2019, make sure you use 2018 and 2019 balance sheets. Conversely, if a current liability, like accounts payable, increases this is considered a cash inflow. This is because the company has yet to pay cash for something it purchased on credit. Another useful aspect of the cash flow statement is to compare operating cash flow to net income.

Cash flow statement vs. balance sheet vs. income statement

It has a net outflow of cash, which amounts to $7,648 from its financing activities. A cash flow statement (CFS) is a financial statement that captures how much cash is generated and utilized by a company or business in a specific time period. For investors, the CFS reflects a company’s financial health, since typically the more cash that’s available for business operations, the better. Sometimes, a negative cash flow results from a company’s growth strategy in the form of expanding its operations. Investing activities include any sources and uses of cash from a company’s investments.

Indirect Cash Flow Method

A company’s 3 main financial statements are the cash flow statement, the balance sheet, and the income statement. Each document provides a different perspective on the company’s financial positioning and business performance, so it’s a good idea to look at all 3 to get a more complete picture accounting for long of how the company is doing. The operating activities section of a cash flow statement summarizes cash inflows and outflows involved with running the business itself. Inflows might include cash received from customers, and outflows might include cash paid to suppliers and employees.

Cash flows are reported on a cash flow statement, which is a standard financial statement that shows a company’s cash sources and use over a specified period. Corporate management, analysts, and investors use this statement to judge how well a company is able to pay its debts and manage its operating expenses. The cash flow statement is one of several financial statements issued by public companies, which also include a balance sheet and an income statement. Direct cash flow statements show the actual cash inflows and outflows from each operating, investing, and financing activity.

Cash Flows from Investing Activities

Therefore, companies typically provide a cash flow statement for management, analysts and investors to review. Often used interchangeably with the term, “statement of cash flows,” the cash flow statement tracks the real inflows and outflows of cash from operating, investing and financing activities over a pre-defined period. Cash flow statements are one of the three fundamental financial statements financial leaders use. Along with income statements and balance sheets, cash flow statements provide crucial financial data that informs organizational decision-making. While all three are important to assessing a company’s finances, some business leaders might argue that cash flow statements are the most important. The statement of cash flows is one of the main financial statements produced by a business, alongside the the income statement and balance sheet.

- It is useful to see the impact and relationship that accounts on the balance sheet have to the net income on the income statement, and it can provide a better understanding of the financial statements as a whole.

- For instance, if a company realizes that it will have a cash shortfall in the next month, it can take steps to ensure enough funds are available.

- Next, our company’s long-term debt balance was assumed to be $80m, which is decreased by the mandatory debt amortization of $5m.

- During the reporting period, operating activities generated a total of $53.7 billion.

Figure 12.9 provides a summary of cash flows for operating activities, investing activities, and financing activities for Home Store, Inc., along with the resulting total decrease in cash of $98,000. When preparing the operating activities section of the statement of cash flows, increases in current assets are deducted from net income; decreases in current assets are added to net income. The change in net cash for the period is equal to the sum of cash flows from operating, investing, and financing activities. This value shows the total amount of cash a company gained or lost during the reporting period.

Next, we will discuss how to use cash flow information to assess performance and help in planning for the future. Recall the dialogue at Home Store, Inc., between John (CEO), Steve (treasurer), and Linda (CFO). John was concerned about the company’s drop in cash from $130,000 at the beginning of the year to $32,000 at the end of the year. He asked Linda to investigate and wanted to know how much cash was generated from daily operations during the year. As you read the dialogue that follows, refer to Figure 12.8; it is the statement of cash flows that Linda prepared for the meeting. Before moving on to step 2, note that investing and financing activities sections always use the same format whether the operating activities section is presented using the direct method or indirect method.

However, investors usually prefer that companies generate their cash flow primarily from business operations. However, that’s not always a bad thing, as it may indicate that a company is making investments in its future operations. Tallying all these adjustments to net income shows Clear Lake’s net cash flows provided by operating activities of $53,600 (see Figure 5.16). This would impact the cash flows from investing activities section since there would be an additional cash receipt. Next, we will discuss the cash flows involving a company’s investing activities. If an adjustment to the amount of net income is in parentheses, it is subtracted from net income.

However, when interest is paid to bondholders, the company is reducing its cash. And remember, although interest is a cash-out expense, it is reported as an operating activity—not a financing activity. Changes in cash from investing are usually considered cash-out items because cash is used to buy new equipment, buildings, or short-term assets such as marketable securities. But when a company divests an asset, the transaction is considered cash-in for calculating cash from investing. Changes made in cash, accounts receivable, depreciation, inventory, and accounts payable are generally reflected in cash from operations. Earlier we discussed how the cash from operating activities can use either the direct or indirect method.

Our platform features short, highly produced videos of HBS faculty and guest business experts, interactive graphs and exercises, cold calls to keep you engaged, and opportunities to contribute to a vibrant online community. Harvard Business School Online’s Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.